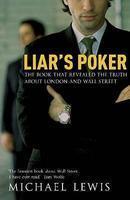

Liar’s Poker is a book by Michael Lewis that describes his time during the late 1980s at Salomon Brothers, a Wall Street investment bank. It also tells the story of the firm itself, especially its hits (with mortgage bonds) and misses (with junk bonds), as it rose to become a mighty power in the financial markets and subsequently fell into disgrace from that position. The book provides an interesting look into the mad, testosterone-filled world of financial traders as it was during a crucial turning point for Wall Street.

The author weaves two narrative threads into the book: his own experience at Salomon Brothers and the story of the rise and fall of Salomon Brothers, peppering these with commentaries on crucial events that shaped the financial markets during the 1980s. The feel of the book changes as the author switches between the two threads - autobiographical in some places, journalistic in others. I found this a little jarring, though the prose remains highly entertaining throughout.

Some of the characters and events described in this book are incredible. These include John Gutfreund, the firm's CEO, Lewis Ranieri, the head of the mortgage department who started off in the mail-room, John Meriwether, the head of the fixed-income arbitrage group and one of the finest bond traders, etc. If you have always cringed at the astonishing paychecks and bonuses given to many traders at Wall Street or if you despise the way they seem to actively misguide their customers to further their own interests, you will find a wealth of material here to support your theses. If you have ever worked in a large organization, you will have much to empathize with in this book.

The author has a knack for simplifying financial jargon and making it accessible to the lay reader. He explains how bonds work, how mortgage bonds are created, what is meant by Collateralized Mortgage Obligation (CMO), what are junk bonds, how traders exploit opportunities for arbitrage, etc. This is crucial as the creation and usage of some of these financial products is central to some of the parts of the narrative. What make the book truly readable though are the author's sense of humor, sharp observational skills and a consistent focus on key people and their interactions.

Read this book to get a good insight into why Wall Street behaves the way it does and why global financial markets have grown so big so fast in the last few decades.